For our purposes, assume that we are closing the books at the end of each month unless otherwise noted. We at Deskera offer the best accounting software for small businesses today. Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary. Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750.

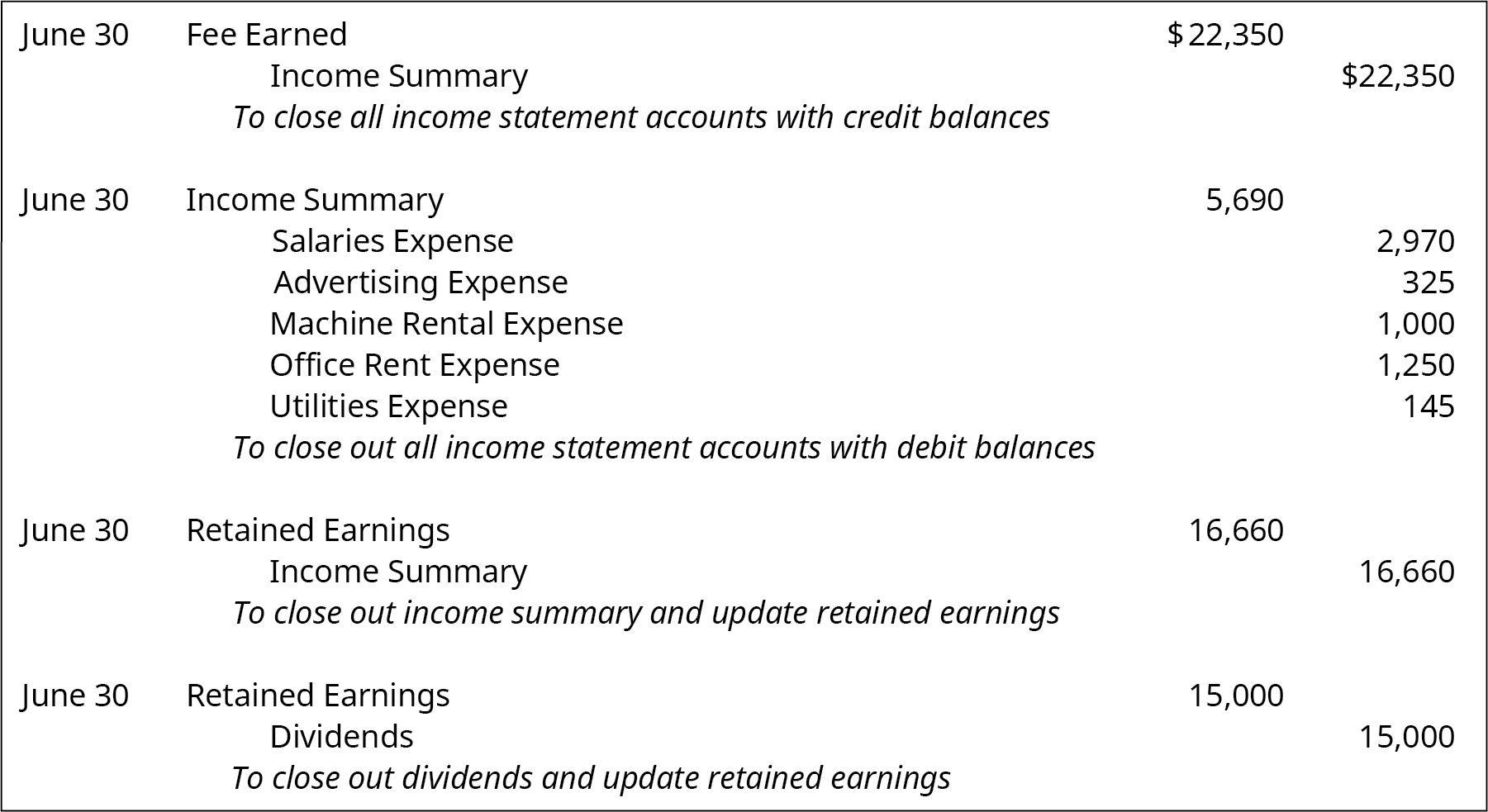

Step 2: Close all expense accounts to Income Summary

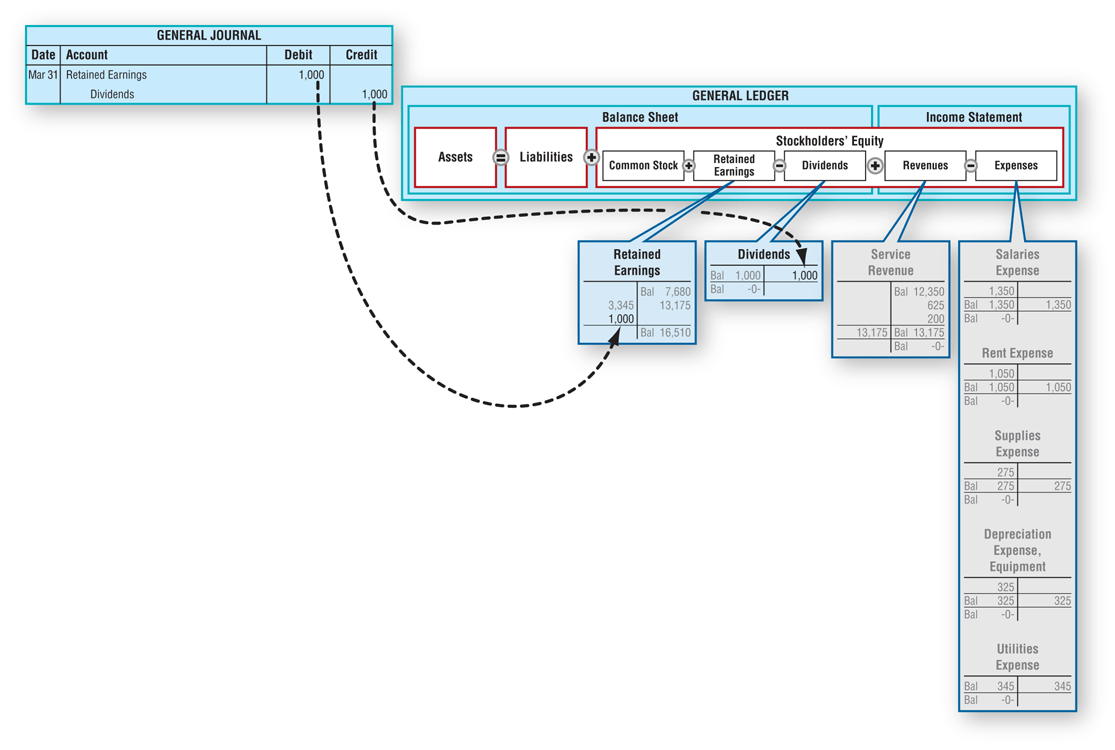

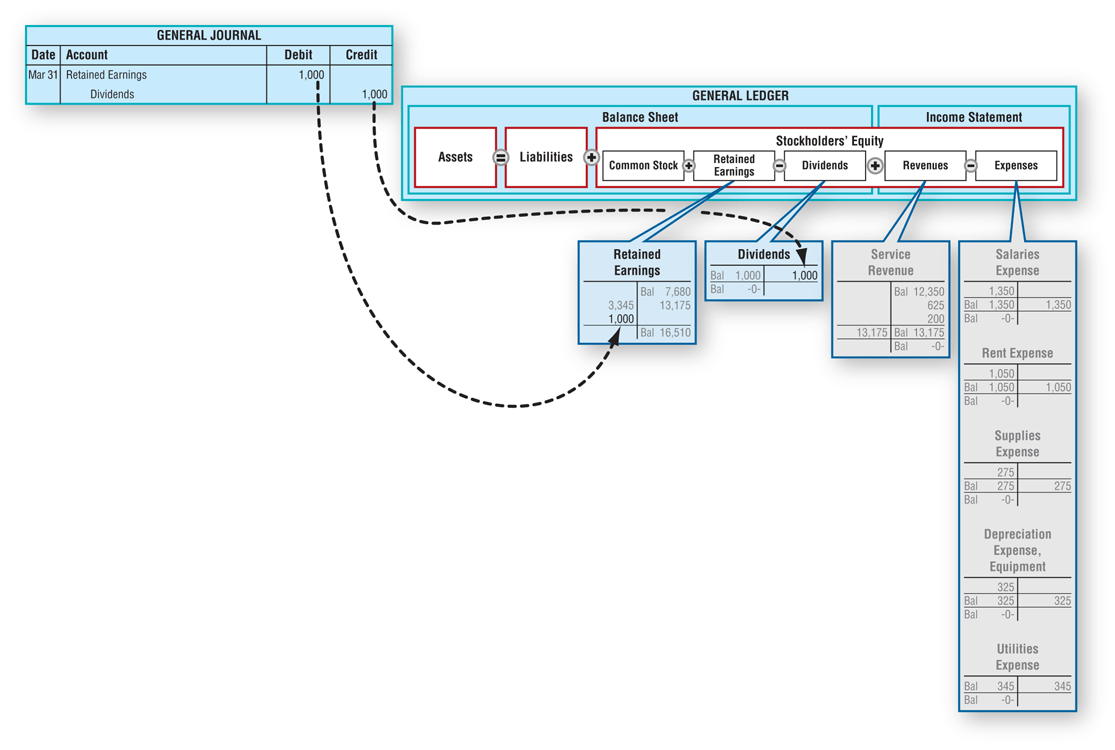

These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper period andthen start over the following period. In summary, permanent accounts hold balances that persist from one period to another. In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries. Instead, the basic closing step is to access an option in the software to close the reporting period.

Reviewed by Subject Matter Experts

These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

- Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary.

- All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary.

- In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

- Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc.

Drawings Accounts and Closing Journals

Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. The net income (NI) is moved into retained earnings what is an accrued expense square business glossary on the balance sheet as part of the closing entry process. The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors.

All expenses can be closed out by crediting the expense accounts and debiting the income summary. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company.

Part 2: Your Current Nest Egg

The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement. Both closing and opening entries record transactions, but there is a slight variation in their purpose. If dividends were not declared, closing entries would cease atthis point.

As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. The purpose of the income summary is to show the net income (revenue less expenses) of the business in more detail before it becomes part of the retained earnings account balance. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200. Why was income summary not used in the dividends closing entry?

All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year. In essence, we are updating the capital balance and resetting all temporary account balances. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

Recent Comments